11+ a real estate loan payable in periodic installments

NRS 125005 Referees in certain judicial districts. The lessee has historically experienced.

Ex1011loanagreementvista

You werent in the uniformed services during this period.

. Value of an Annuity present value of cash flow. The forgiveness of a PPP loan creates tax-exempt income so you dont need to report the income on Form 1040 or 1040-SR but you do need to report certain information related to your PPP loan. Section 1129a3 of the House amendment adopts the position taken in the Senate amendment and section 1129a5 takes the position adopted in the House bill.

On May 1 2021 you borrowed 40000 from your retirement plan. So i received net commissions of 90 percent after deducting the CWT. That is the seller of the CDS insures the buyer against some reference asset defaulting.

A the name of. Interest on the portion of the tax in excess of the 2 portion is figured at 45 of the annual rate of interest on underpayments. Mortgage Calculator solves for 6 variables.

Resident aliens are generally treated the same as US. In 2021 you took out a 100000 home mortgage loan payable over 20 years. 5 specifies the details of any insurance policy relating to the property including.

And C the account number. They may be paid annually quarterly monthly etc. Payable with each periodic payment.

Comments and suggestions. You must capitalize the 3000 and amortize it over the 20-year term of the lease. For an estate of a decedent who died in 2022 the dollar amount used to determine the 2 portion of the estate tax payable in installments under section 6166 is 1640000.

The loan was to be repaid in level monthly installments over 5 years. A the loan must be voluntarily created with the consent of each owner of your home and each owners spouse. NRS 125007 Order for medical and other care support education and maintenance of children required before granting of divorce separate maintenance or annulment.

You can deduct 60 4800 240 months x 3 payments in 2021. Establish loan origination and approval procedures both generally and by size and type of loan. Official interpretation of Paragraph 18s3iC.

The buyer of the CDS makes a series of payments the CDS fee or spread to the seller and in exchange may. Form W-4P is used to request withholding on periodic payments. Annual or periodic FDAP see definition below.

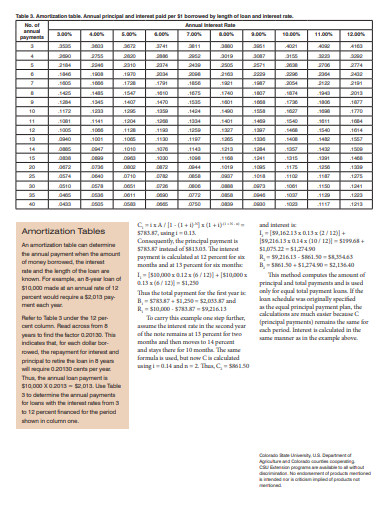

Equated monthly installments are used to pay off both interest and principal each month so that over a specified number of years the loan is fully paid off along with interest It further explains that with most common types of loans such as real estate mortgages the borrower makes fixed periodic payments to the lender over the course of. You made 3 monthly payments on the loan in 2021. Or a real estate investment trust REIT on undistributed long-term capital gains included in the corporations income.

This revenue procedure addresses the federal income tax treatment and information reporting requirements for payments made to or on behalf of financially distressed individual homeowners by certain entities with funds allocated from the Homeowner Assistance Fund HAF established under section 3206 of the American Rescue Plan Act of 2021 Pub. Typical examples are real estate settlement charges and premiums for voluntary credit life and disability insurance excluded from the finance charge under 10264. In exchange you agree to pay an additional rent amount of 3000 payable in 60 monthly installments of 50 each.

B the periodic installments required to be paid. NW IR-6526 Washington DC 20224. You use the cash method of accounting.

The installments are due by the 15th day of the 4th 6th 9th and 12th months of the tax year. You make nine monthly payments and start an unpaid leave of absence that lasts for 12 months. 512022 65303 PM--2021 CHAPTER 125 - DISSOLUTION OF MARRIAGE.

I am a real estate broker and registered as a corporation. To find out how to report information related to your PPP loan see Forgiveness of Paycheck Protection Program PPP Loans under Income in the. Your amortization deduction each year will be 150 3000 20.

Loan calculator solve for any unknown. Establish prudent underwriting standards that are clear and measurable including loan-to-value limits that are consistent with these supervisory guidelines. 4 indicates whether the lienholder has consented to the transfer of the property to the purchaser.

How much CWT must i withold from the agent na nag override lang ako 10 per cent ba or subcon tax lamang na 2 per cent. The terms of the loan are the same as for other 20-year loans offered in your area. An adjustable-rate loan that has fixed periodic payments that do not adjust.

Now i have to pay commissions to the real estate salesperson under me from the same transactions. The term does not include charges as a result of default additional charges Section 37-3-202 delinquency charges Section 37-3-203 or deferral charges Section 37-3-204 or in a consumer loan which is secured in whole or in part by a first or junior lien on real estate charges incurred for appraising the real estate that is collateral. Balloon Loan structure loan with balloon.

You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Section 1129a7 adopts the position taken in the House bill in order to insure that the. Table A provides a list of questions and the chapter or chapters in this publication where you will find the related discussion.

Identify appropriate terms and conditions by type of real estate loan. NW IR-6526 Washington DC 20224. The lease term is one year and provides that the lease payments are 12 million payable in equal monthly installments on the first day of each month plus one percent of the lessees net sales in excess of 25 million if the net sales exceed 25 million during the lease term ie contingent rental.

You paid 4800 in points. We welcome your comments about this publication and suggestions for future editions. Periodic payments are those made in installments at regular intervals over a period of more than 1 year.

Application means the submission of a borrowers financial information in anticipation of a credit decision relating to a federally related mortgage loan which shall include the borrowers name the borrowers monthly income the borrowers social security number to obtain a credit report the property address an estimate of the value of the property the mortgage loan amount sought. The loan wasnt used to acquire your main home. Citizens and can find more information in other IRS publications at IRSgovForms.

Withholding from periodic payments of a pension or annuity is generally figured in the same manner as withholding from wages. B the principal loan amount at the time the loan is made must not exceed an amount that when added to the principal balances of all other liens against your home is more than 80 percent of the fair market value of your home. A credit default swap CDS is a financial swap agreement that the seller of the CDS will compensate the buyer in the event of a debt default by the debtor or other credit event.

Credit for Federal Tax on Fuels. Section 1129 of the House amendment relates to confirmation of a plan in a case under chapter 11. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave.

The information in this publication is not as comprehensive for resident aliens as it is for nonresident aliens. We welcome your comments about this publication and suggestions for future editions. Net Worth assets minus liabilities.

Auto Loan supports optional trade in or deposit. Debt Payback evaluate 4 debt elimination plans. We would like to show you a description here but the site wont allow us.

Installment Buying Rule Of 78 And Revolving Charge Credit Cards Ppt Download

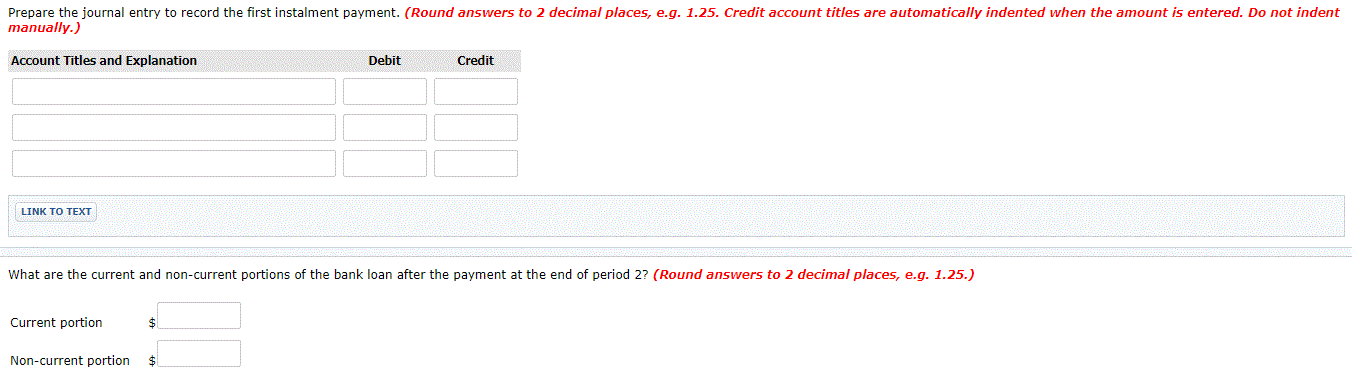

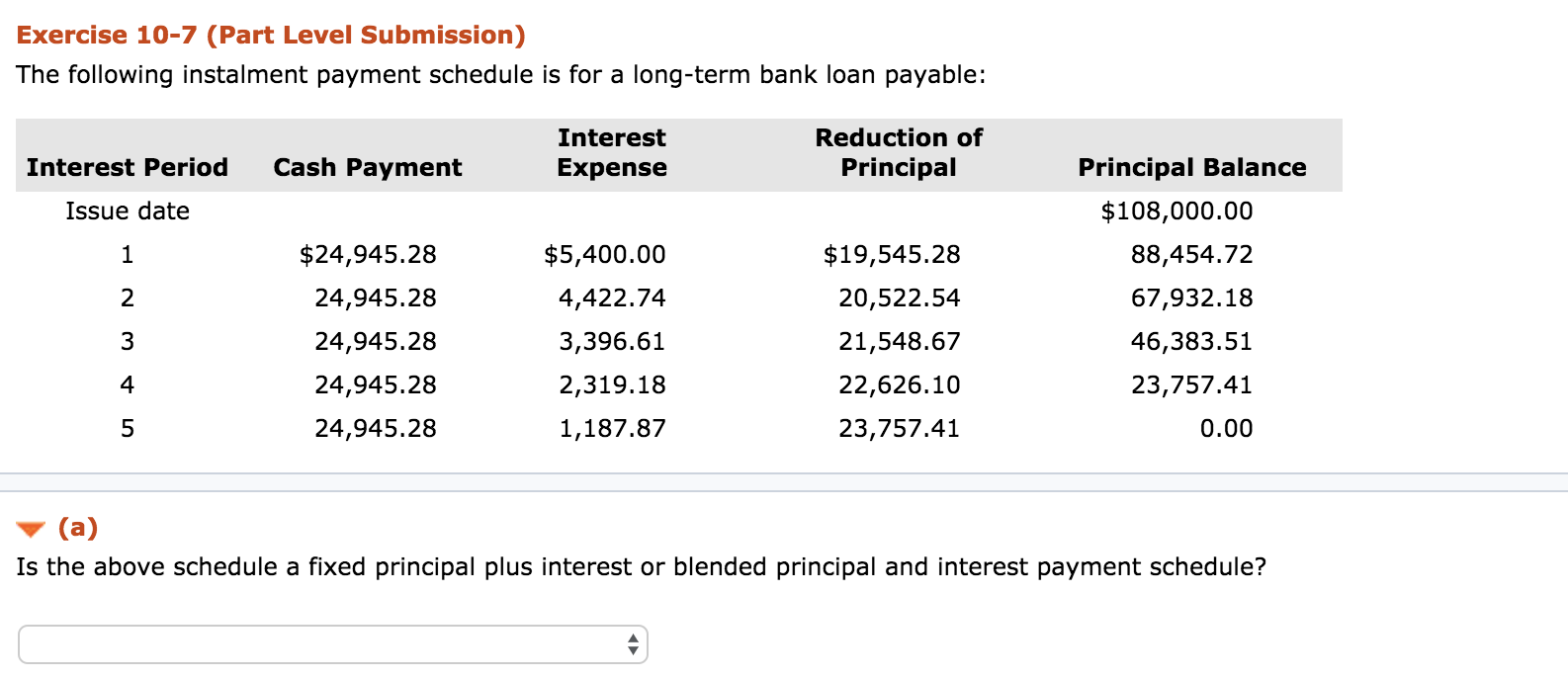

Solved The Following Instalment Payment Schedule Is For A Chegg Com

Loan Payment Schedule 10 Examples Format Pdf Examples

N Ceunes

Types Of Term Loan Payment Schedules Ag Decision Maker

Leslie And Ben Buy A House For 350 000 Using A Simple Interest Amortized Loan With An Annual Interest Rate Of 7 And Monthly Payments For A Term Of 30 Years A What

Free 9 Sample Assignment Of Mortgage Templates In Pdf Ms Word

Loan Payment Schedule 10 Examples Format Pdf Examples

Solved Exercise 10 7 Part Level Submission The Following Chegg Com

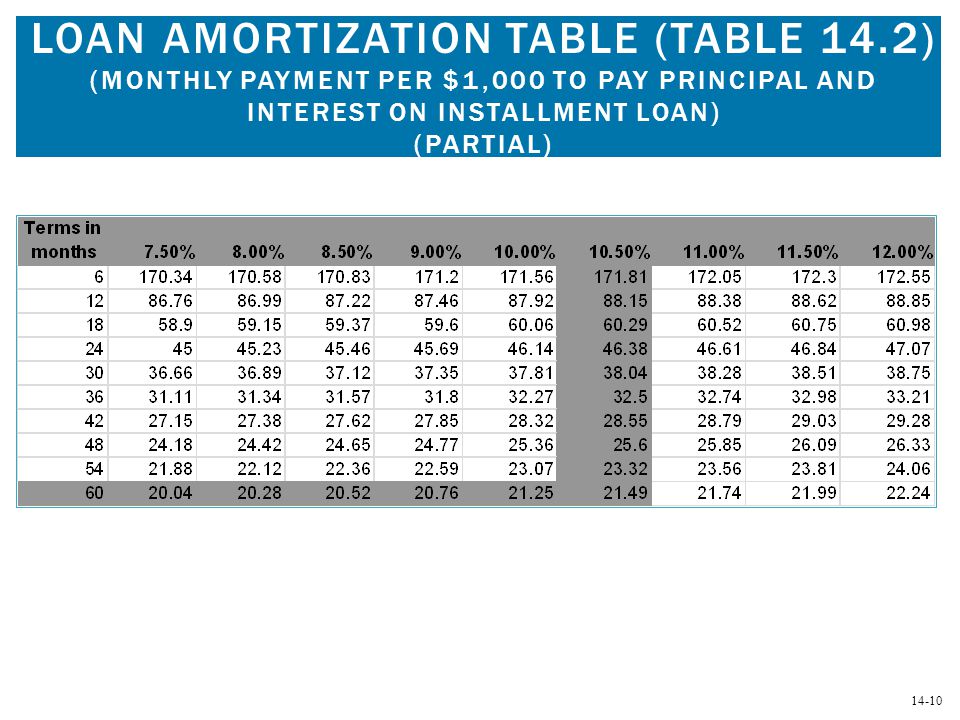

Installment Buying Chapter Fourteen Mcgraw Hill Irwin Ppt Video Online Download

5 Commercial Real Estate Loan Terms You Should Know Break Into Cre

Installment Notes Double Entry Bookkeeping

Hammock Made By Landlords For Landlords

Solved An Amortization Table Reports The Amount Of Interest Chegg Com

Free 10 Installment Payment Contract Samples In Pdf

Ex1011loanagreementvista

Great West Life Annuity Insurance Co Prospectus 424b3